NetSuite 2019 Release 2 (NetSuite 2019.2) is bringing some very exciting features with it, including some major updates to its banking system.

It feels like the last piece of the puzzle, NetSuite has been known as the best cloud ERP system for over 10 years but there’s been one gap in that bank feeds were not standard within the application.

2019.2 changes that, as it now provides an sFTP option to import bank statements directly with NetSuite.

sFTP is okay, but it’s old technology that requires setup from your banking provider. This may be a solution for some customers, but for the majority it isn’t a great option.

There is good news however, due to the recent government regulation changes in Australia on Open Banking via the Farrell Report the API option is coming which will allow direct bank feeds into NetSuite.

Major Australian and New Zealand banks (ANZ, CBA, NAB & Westpac) will need to open up API access so data can be pushed directly into NetSuite without the need of SFTP. There are a few phases in the roll-out, but by early 2020 banks should have the information available to start implementing the API option for NetSuite.

Subscribe here to get the updates about availability.

[gravityform id=3 title=false description=false ajax=true tabindex=49]Here’s an overview of new banking features coming in NetSuite 2019.2:

Advanced Banking Data Import

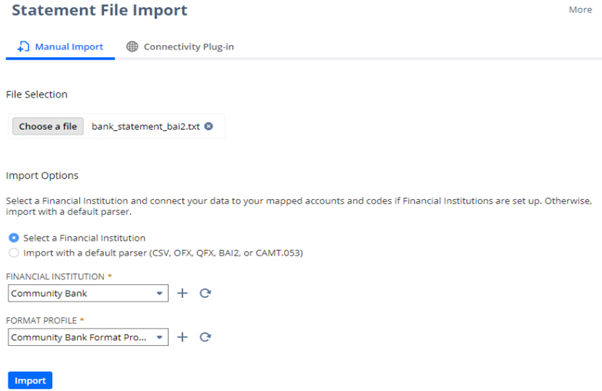

Previously, users had to download a bank statement from their financial institution and then import the statement into their NetSuite account using NetSuite’s default parser behaviour.

If the imported statement was in a file format that NetSuite’s built-in parsers supported, the import was successful.

Now, users can configure custom parsers in a Format Profile of a Financial Institution record. Users can then import files in the format from the financial institution for which they configured the parser.

Using the Parser plug-in, administrators can create and upload their own parsers for different bank and credit card statement formats and implement them in NetSuite.

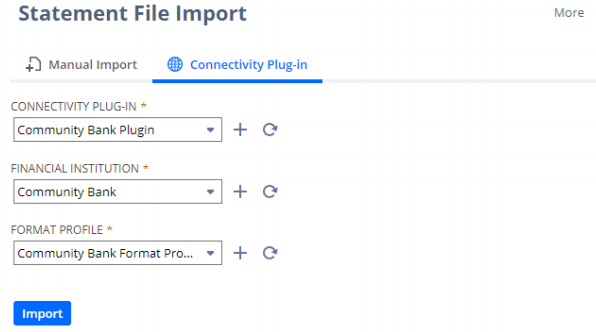

Direct Bank Connectivity

Another major update in 2019.2 is that users can now use the Bank Connectivity plug-in to forgo manual uploads and automate the bank connectivity process.

By using an sFTP connection, NetSuite can directly connect to a financial institution and retrieve bank statement files for users.

Asynchronous Importing

One of the most important changes this update will make is in terms of the statement import process.

In previous iterations this process was synchronous, which means that users had to keep the Statement File Import page open and wait for the import to complete before they could perform another action.

Also, the import process often failed if it exceeded the configured time-out settings.

Now, the import process is asynchronous, which means users no longer need to wait on the page until the import is done and can perform other actions while the process is ongoing.

Users can import multiple bank statements at the same time, but the number of simultaneous imports is limited depending on the NetSuite Service Tier.

As well as this the import process no longer fails if it exceeds the configured time-out settings, which for many users will be a big relief.

Other new Banking Features

- Financial Institution Records – As of 2019.2, NetSuite includes the new Financial Institution and Format Profile records. Users can now map accounts and bank transaction codes for multiple accounts in a Format Profile of a Financial Institution record.

- Exclude Bank Account Transaction Codes – Users sometimes need to exclude certain bank account transactions included in bank statement file imports from the statement import. With this update that process is simplified as uses can exclude any transaction type codes from the file import.

NetSuite 2019.2 is changing a lot of features, subscribe below to stay up to date.

[gravityform id=3 title=false description=false ajax=true tabindex=49]